Best Versus the Worst Performing Agents for FCR and Their Impact on Costs

In many cases, Agents represent 60% to 75% of the call center's annual operating costs. Also, Agents are the second biggest source of error (i.e., 40% of the time) for not achieving First Call Resolution (FCR). So, making modest improvements in reducing Agent-caused repeat calls represents enormous financial returns and, most importantly, protects customers from defecting to other organizations.

Many call center leaders are unaware of the differences between the best versus the worst-performing Agents for FCR and the impact on costs. SQM's Voice of the Customer (e.g., post-call survey) research of over 500 leading North American call centers indicates a profound difference between the top Agent performers and the bottom Agent performers for delivering Voice of the Customer (VoC) FCR and call resolution.

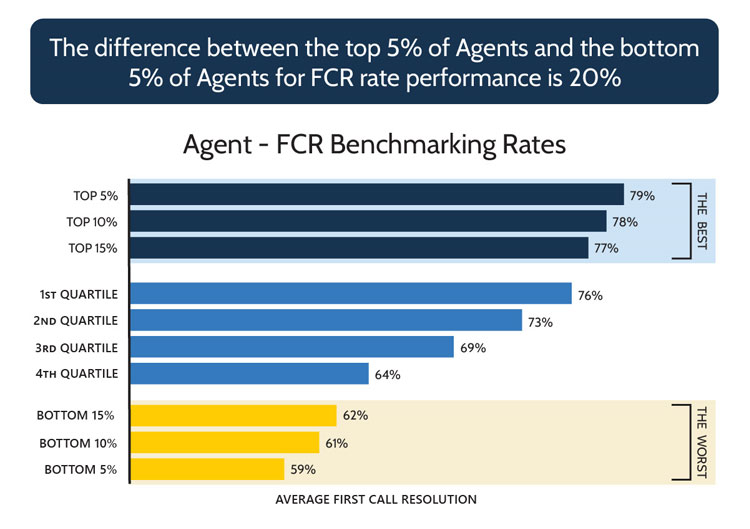

Agent - FCR Benchmarking Rates

Figure 1 shows Agent – VoC FCR benchmarking rates for the best (i.e., top 15%) Agents FCR rate is 77%, which is a very impressive rating. SQM considers the 80% FCR rate to be at the world-class level. Conversely, the worst (i.e., bottom 15%) Agents FCR rate is 62%, a 4th quartile level.

The difference between the top 5% of Agents and the bottom 5% of Agents for FCR performance is 20%. Interestingly, in some world-class call centers, there is very little difference between the best and the worst Agents for FCR performance. Conversely, it is not uncommon for third and fourth quartile FCR performing call centers to see a 30% to 40% difference between the best and worst Agents for FCR performance.

Figure 1: Agent - FCR Benchmarking rates

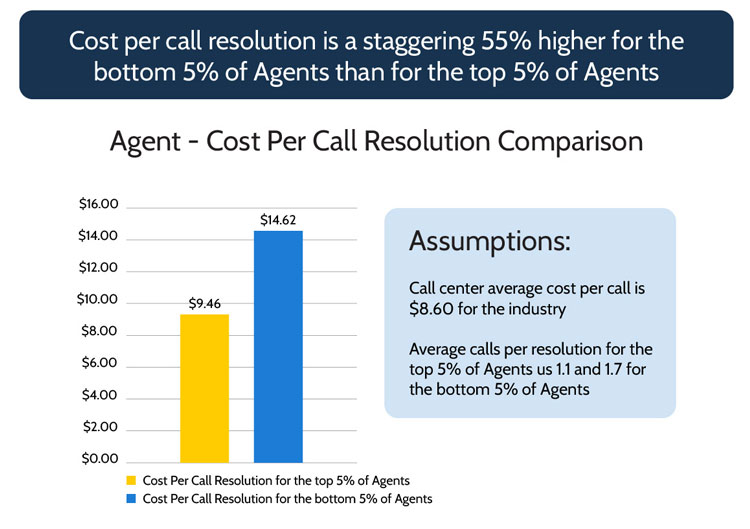

Agent - Cost Per Call Resolution

SQM's research shows the call center industry's average cost per call is $8.60. Cost per call resolution factors in cost per call and the average number of calls it takes to resolve customer inquiries or problems. Figure 2 shows Agent - cost per call resolution comparison based on the average cost per call and the average number of calls it takes to resolve a call for the top 5% of Agents ($8.60 x 1.1) is $9.46, and for the bottom 5% of Agents ($8.60 x 1.7) is $14.62. Cost per call resolution is a staggering 55% higher for the bottom 5% of Agents than for the top 5% of Agents.

Figure 2: Agent - Cost Per Call Resolution Comparison

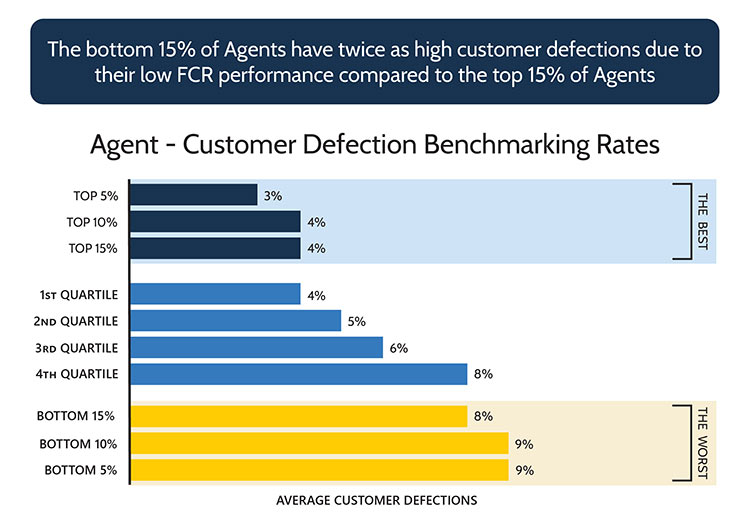

Agent - Customer Defection Benchmarking Rates

Figure 3 shows for Agent - customer defection benchmarking rates, the bottom 15% of Agents have twice as high customer defections due to their low FCR performance compared to the top 15% of Agents. In many cases, the call center contact channel is the last line of defense for a customer defecting. Many leaders believe that one of the call center's primary purposes is to help retain customers. SQM's opinion is that most leaders are unaware of the differences between the best and worst-performing Agents for FCR and call resolution and their impact on customer defections.

Figure 3: Agent - Customer Defection Benchmarking Rates

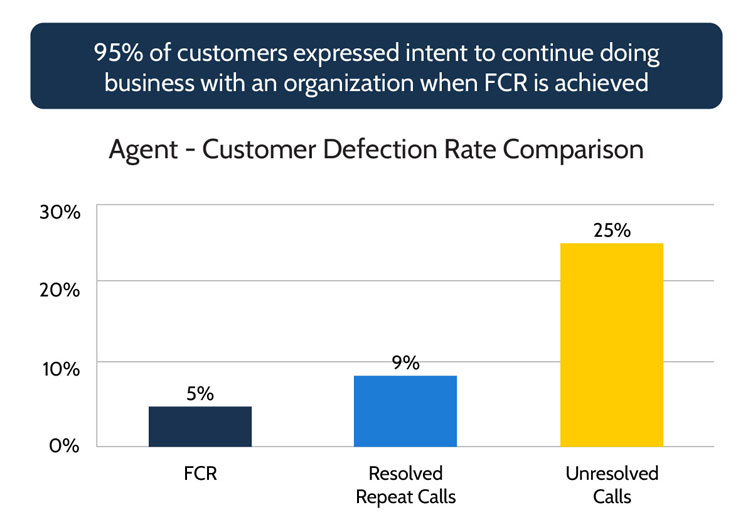

Agent - Customer Defection Rate Comparison

Figure 4 shows Agent – customer defection rate comparison that 95% of customers expressed intent to continue doing business with an organization when FCR is achieved. The real opportunity for call centers to help improve their organization's financial performance is to reduce customer defections.

It has been SQM's experience that call center leaders who are focused on lowering repeat calls will improve their operating costs and will reduce their customer defections at the same time. However, more effort needs to be placed on identifying customers whose calls are not resolved. Customers whose calls are not resolved will be those who are most likely to defect to a competitor due to their call center experience.

SQM's research shows when customers receive FCR, only 5% of those customers expressed their intent to defect. When call resolution takes two or more calls, 9% of those customers said they intended to defect, but a staggering 25% of customers expressed intent to defect when the call is unresolved.

Figure 4: Agent - Customer Defection Rate Comparison

Summary

It is a well-accepted fact that it costs organizations at least five times more to attract a new customer than to retain an existing one. Therefore, the value of keeping existing customers over acquiring a new one can't be overstated.

In many cases, when both customer defection and repeat call costs are factored in, it would be cheaper for call centers to pay the worst-performing Agents to stay at home and replace them with new Agents rather than have the worst performing Agents take calls. Clearly, paying Agents to stay home would not be a good practice, but some Agents should not be working in call centers. Call centers need to understand the differences between the best versus the worst-performing Agents for FCR and their impact on costs.

If call centers are genuinely interested in improving their FCR and providing great customer service, they need to create more accountability to these metrics at the Agent level. Furthermore, call centers should ensure that all Agents have been adequately trained, coached, and incentivized to improve their call resolution performance. Improving Agent call resolution performance will lead to an improvement in FCR at the call center level.

The call center is the primary or the only contact channel customers use for receiving support for using an organization's products and services. The call center plays a critical role in helping retain customers and, in most cases, only has three opportunities or less per year to help each customer resolve their inquiry or problem. So, the Agent should view each customer call as a unique opportunity to resolve their call and recognize that, by doing so, they are playing a significant role in satisfying and retaining customers and improving the financial performance of the organization.

Quick Related Links

First Call Resolution Definition First Call Resolution PPT First Call Resolution Benefits Agent Coaching First Call Resolution Call Handling First Call Resolution Tips VoC Performance Management Agent Recognition CQA Form Customer Quality Assurance