The Impact of FCR on Customer Retention

What is a Net Retention Index?

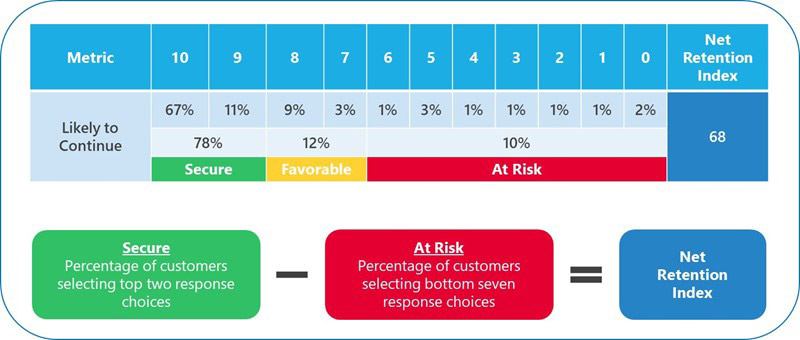

At SQM, we use the Net Retention Index (NRI) to help determine transactional customer retention when using a call center. A transactional NRI is based on using a contact channel (e.g., call center, email, chat, website), which is different from the traditional perceptional of NRI which is based on the overall relationship a customer has with a company.

The transactional NRI is determined using a post-call survey and asking the question, "based on your last call to their call center and if you had the choice, using a scale of 0 to 10, where 0 means Not at All Likely, and 10 means Extremely Likely, how likely are you to continue to do business with XYZ Company?" Their responses are categorized into three groups: Secure (those who answered 9 and 10), Favorable (those who answered 7 and 8), and at Risk (those who answered 0 to 6). The transactional NRI is then calculated as the percentage of customers identified as Secure minus the percentage of at Risk of Defections. To get a clear picture of whether First Call Resolution positively impacts customer retention, it is a best practice to use a post-call survey to measure First Call Resolution and NRI metrics.

To answer whether First Call Resolution (FCR) positively impacts transactional customer retention, we surveyed customers who used a call center within one business day with leading North American organizations. SQM Group's research shows 95% of customers expressed intent to continue doing business with an organization when FCR is achieved. FCR and transactional NRI have a statistical correlation of .61, which would be considered high and shows that FCR positively impacts transactional NRI. Furthermore, every 1% improvement in FCR increases transactional NRI® by .5 point for the average call center.

Many call center leaders believe that transactional NRI is an appropriate metric to evaluate their department's contribution to customer retention at the enterprise level. Furthermore, in many cases, the call center is the last line of defense for stopping customers from defecting to another organization. As a result, the transactional NRI is an excellent indicator if the call center is helping the organization maintain or improve customer retention.

There are some questions on the appropriateness of NRI as a measure of Agent performance. Most frontline Agents do not like to be held accountable for transactional NRI. Agents dislike NRI because they feel they have limited control over pricing, policies, products, or services. Many Agents would prefer to be held accountable to the call resolution metric, which they believe they control through their performance. If Agents improve call resolution, it would improve FCR and positively impact transactional NRI.

Figure 1 shows SQM's call center research for transactional NRI. On average, 78% of customers were Secure, and 10% were at Risk of Defection, resulting in a transactional NRI of 68 points. There is a high variation for transactional NRI by industry. For organizations performing at the world class level for FCR (80% or higher) based on the customer perspective, their transactional NRI is 79 points or higher. Only 5% of call centers have achieved the FCR world class standard of 80%.

Figure 1: Transactional Net Retention Index

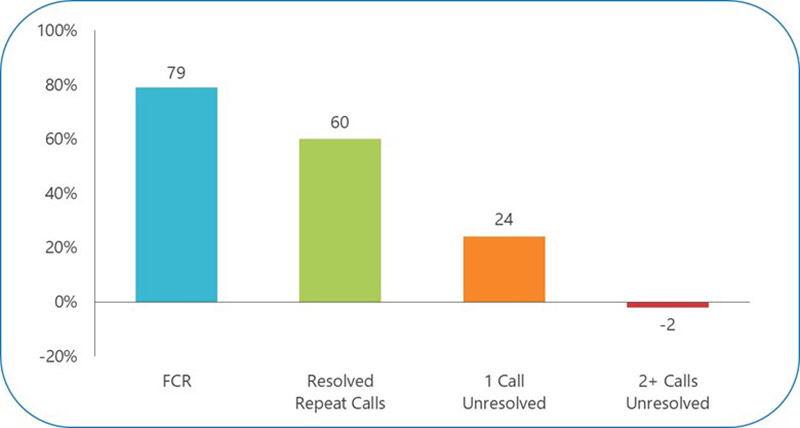

Figure 2 shows SQM's call center research for FCR, Repeat Call, and Call Unresolved Impact on transactional NRI. The data reveals that when customers experience FCR using a call center, the NRI is 79 points. When an inquiry or problem Call was Resolved, but it took repeat calls, the NRI drops to 60 points. When one call took place, and the Call was Unresolved, NRI goes down to 24 points. However, what is most alarming is when two or more calls took place and the Call was Unresolved, NRI is -2 points. Clearly, FCR is a driver for improving transactional NRI. Calls unresolved is the driver for lower NRI and at Risk of Defection customers.

Figure 2: FCR and Repeat Call / Call Unresolved Impact on Transactional NRI

In Closing

For call centers that want to improve transactional NRI, it is essential to state that FCR and Call Resolution improvement will increase Secure customers and reduce customers at Risk of Defection. Therefore, it will improve your transactional NRI. The best practice is to hold call center leaders accountable to FCR and NRI metrics and the Agents to Call Resolution metric. If Agents improve Call Resolution, it will also improve FCR and positively impact transactional NRI if they improve their performance for the Call Resolution metric.

Quick Related Links

First Call Resolution Definition First Call Resolution PPT First Call Resolution Benefits

First Call Resolution Strategies First Call Resolution Operating Philosophy FCR Case Study Survey Data Calculate First Call Resolution Rate What Is a Good FCR Rate? Customer Quality Assurance VoC Closed-loop Top 10 Call Center Metrics VoC Performance Management