Collecting and Actioning Customer Surveys Business Case

According to an old Gartner statistic: 95% of companies collect customer feedback. Yet only 10% use the feedback to improve customer experience (CX), and only 5% tell customers what they are doing in response to what they heard. The Gartner stats may be older but are still directionally correct today for the relationship surveying method.

However, SQM's experience has shown that contact centers conducting post-contact First Contact Resolution (FCR) and CX transactional surveys have a substantially better track record for using customer feedback to improve FCR and CX. In fact, over 70% of SQM Group's clients improve their FCR and CX due to collecting and actioning Voice of the Customer (VoC) transactional surveys.

According to Reichheld, "In general, the longer a customer stays with a company, the more that customer is worth. This is because long-term customers buy more, take less of a company's time, are less sensitive to price, and bring in new customers. Best of all, they have low acquisition or start-up costs. As a result, long-term customers are worth so much that in some industries, reducing customer defections by as little as five points – from, say, 15% to 10% per year – can double profits."

It is well-accepted that it costs organizations at least five times more to attract a new customer than to retain an existing one. Therefore, the value of keeping existing customers over acquiring a new one can't be overstated.

SQM's research shows when customers receive FCR, only 5% of those customers express their intent to defect. However, when contact resolution takes two or more calls, 9% of those customers said they intended to defect, but a staggering 25% of customers expressed intent to defect when the call is unresolved.

In addition, SQM's research shows for every 1% improvement in FCR, there is a 1% improvement in customer satisfaction (Csat). The FCR metric has the highest correlation to Csat out of all contact center internal or external metrics. The absence of FCR is the strongest driver of customer dissatisfaction. Csat (top box response) average drops 15% every time a customer contacts back to resolve their initial contact.

Conducting relationship surveys and transactional surveys is vital in enabling an organization to effectively measure if the contact channels contribute to customer loyalty and reduce operating costs.

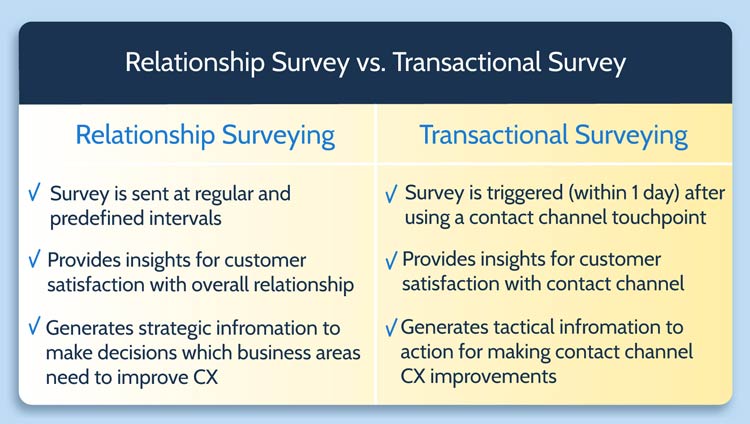

The Difference Between Relationship Survey and Transactional Survey

In most cases, CX improvement efforts come from customer feedback to help an organization determine and make improvements. There are two different types of surveys used to improve CX: Relationship survey and Transactional survey. Each survey method is designed to measure something specific. This section of the blog will discuss these two survey types.

Relationship surveys are typically sent at regular and predefined intervals. They provide insights into customer satisfaction with the overall relationship with an organization and brand. Moreover, they generate strategic information to make decisions about which business areas need to improve CX.

Transactional surveys are triggered (within one day) after using a contact channel touchpoint. They provide insights for customer satisfaction with a contact channel. Furthermore, they generate tactical information to action for making contact channel CX improvements.

Relationship surveys and transactional surveys both add value in helping to understand and improve CX. Below are strengths and weaknesses for each survey type.

The strengths of the relationship survey type are that it can provide an understanding of how you are performing at the enterprise level for key global metrics like Csat, customer retention, and Net Promoter Score™. Furthermore, the relationship survey method can create accountability at the line of business level to help drive CX improvement.

Relationship surveying goes beyond a moment-of-time interaction by measuring customers' overall perception of their relationship with an organization based on their lifecycle stage (e.g., brand awareness, purchasing, onboarding, servicing, renewing) experiences. Also, a relationship surveying method is a practical approach when measuring B2B interactions with high frequency and repetitiveness to identify CX improvement opportunities.

The weaknesses of relationship surveys are they can lack actionable customer feedback to improve CX. The survey data is helpful for overall CX insights but, in most cases, requires additional insights to determine what and how to improve CX.

The strengths of the transactional survey type are that it can provide an understanding of contact channel CX and opportunities to improve. SQM's experience has shown that the transactional survey method is more effective than the relationship survey for understanding and identifying opportunities to improve contact channel CX.

Transactional surveys are usually conducted within one day of doing business with an organization's contact channel. Moreover, the information generated is tactical (what needs to improve), and accountability for CX can go from the CEO to the Agent level. With increased accountability comes a more significant commitment to improving the contact channel customer experience.

The weaknesses of the transactional surveying method are trying to measure the overall customer relationship with the organization (e.g., overall Csat, customer retention, and Net Promoter Score). A specific transaction or one moment of time is not always an indicator of the overall customer relationship with an organization.

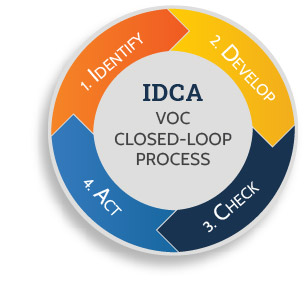

Customer-centric Organizations are Employing a VoC Closed-Loop Process

If customers take the time to provide feedback to help contact channels improve service, organizations should close the loop with customers. Put simply, after receiving the customer feedback, action it and share it with customers.

A VoC closed-loop process starts with identifying service gaps by capturing customer survey feedback and ends with actioning customer feedback. What is important is that people, processes, policy, and technology improvements made to improve customer service are verified by the customer that they improved their customer journey. The VoC closed-loop process can be applied to all contact channels.

Contact channel leaders are increasing investments in VoC programs and software that employ a VoC closed-loop process. At SQM, our VoC closed-loop process consists of four steps – Identify, Develop, Check, and Act (IDCA) to improve FCR and CX performance. The four ongoing sequential steps of our IDCA VoC closed-loop process are:

Identify - Repeat call reasons to improve by measuring FCR and Csat performance

Develop - A solution and implement a test pilot to reduce repeat contact reasons

Check - To see if the test pilot was successful by measuring changes in FCR

Act - on customer feedback by implementing a standardized improvement plan for reducing repeat contact reasons for the entire contact channel

mySQM™ FCR Insights Software

Find out why over 500 leading North American contact centers trust mySQM™ FCR Insights Software as a best practice to measure and improve First Contact Resolution. Our software provides First Contact Resolution insights by capturing and reporting external (e.g., post-contact surveys) and internal (e.g., call data, quality assurance) data, all in one powerful First Contact Resolution software platform. In addition, our high-value software is specifically built to help contact channels improve their CX and operating costs. As a result, our client's average ROI is 450%, and the payback period is less than 3 months.

Quick Related Links

First Call Resolution Definition First Call Resolution PPT First Call Resolution Benefits

First Call Resolution Strategies First Call Resolution Operating Philosophy Survey Data Call Center VoC What is a Good FCR Rate? Top 10 CX Metrics VoC Closed-Loop CX Journey Mapping