A vulnerable customer could be a single parent living on a fixed income who faces financial constraints, limited time, and increased responsibilities. These challenges can make them vulnerable to exploitation and marketing tactics or influence their consumer choices based on convenience rather than cost-effectiveness.

A vulnerable customer could also be a recent college graduate burdened with substantial student loan debt. They are vulnerable because of job insecurity, potentially limited financial literacy, and mental health stress due to their financial circumstances. This vulnerability can lead to difficulties in making informed financial decisions, job exploitation, and susceptibility to marketing tactics influenced by their financial stress.

Both examples above are not typically what people imagine when they hear "vulnerable customer." Typically, people will imagine an older person or someone with cognitive disabilities. This blog aims to destigmatize the term "vulnerable customer" by educating readers on what it really means. It also aims to educate call center agents on how these vulnerable customers should be dealt with.

Vulnerable customers make up between 30-50% of all customers who call a call center. This number is much higher than what most people would expect. Many customers who call a call center are calling because they can’t afford the payments or they’re inquiring about insurance policies because of health issues they’re experiencing. Elderly people also make up a large portion of callers because they aren’t comfortable with technological forms of communication.

Businesses and service providers should be considerate of the challenges and unique needs of vulnerable customers when designing products, services, and customer experiences. Providing support and assistance where possible reduces the vulnerability of these customers and improves their overall well-being.

If the call center isn't adequately equipped to handle customer calls in these vulnerable situations, it could potentially harm the company's reputation and, more importantly, negatively affect the customer.

Imagine a scenario where a customer named John, recently injured and in a hospital, seeks clarification on his policy coverage and assistance with medical bills. However, due to long hold times, a lack of empathy, inadequate knowledge, and inefficient communication from the call center, John's experience becomes frustrating and anxiety-inducing.

This lack of support leads to negative public perception, a loss of customer trust, and even potential legal consequences for the company, emphasizing the importance of providing compassionate, efficient, and knowledgeable assistance to customers facing critical situations.

However, helping vulnerable customers isn't just about risk mitigation for companies. It's also about increasing employee satisfaction because people like working for companies that treat customers well. Moreover, when companies create products that work for a wider range of consumers, it opens up more chances to sell things. And when customers feel well-cared for, they tend to stick around for a long time, which is excellent for business.

Who Is a Vulnerable Customer?

First of all, the word 'vulnerable' is controversial due to its potential to stigmatize and label individuals, implying weakness or a lack of capability. It could lead to assumptions or stereotypes about a person's situation. The use of such terminology might also raise concerns about privacy and dignity.

In customer service, focusing on individual needs and challenges rather than generalizing or categorizing individuals can foster a more respectful and inclusive environment. Therefore, it's important to use such terminology with caution, being mindful of the potential for stigmatization and respecting the preferences of the individuals or groups being described.

Vulnerability does not imply a permanent state, and it does not necessarily indicate a lack of competence or understanding. The Financial Conduct Authority (FCA) defines a vulnerable person as: "someone who, due to their personal circumstances, is especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care."

Customers may be vulnerable if they are:

- Elderly

- Chronically ill

- Hearing or speech-impaired

- Cognitively impaired

- Financially distressed

- Non-native English speaker

It is not always easy to identify whether a customer is vulnerable. However, there are some techniques that agents and supervisors can use to help determine which customers could be considered vulnerable.

How Can You Identify Vulnerable Customers?

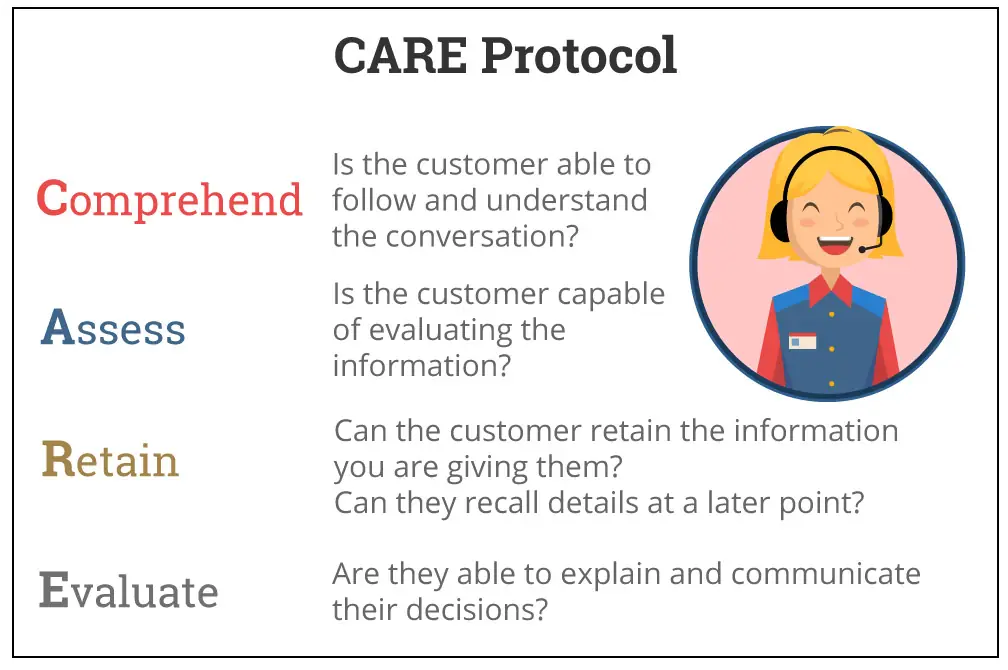

To help with the identification of vulnerable customers, companies can consider the following four questions to see if any apply to the customer. The CARE protocol provides a framework for developing a clearer understanding of your customer.

Comprehend – Is the customer able to follow and understand the conversation?

Assess – Is the customer capable of evaluating the information?

Retain – Can the customer retain the information you are giving them? Can they recall details at a later point?

Evaluate – Are they able to explain and communicate their decisions?

The agents should be trained to ask themselves these questions at each stage. For example, if a customer is simply agreeing with everything the agent is saying, the agent should evaluate whether the customer is actually evaluating the information given to them.

Rather than flagging a customer as vulnerable using a black-and-white system, companies should take a more personalized approach by instead recording the support or assistance a customer requires. This avoids treating all types of vulnerabilities the same and is more accommodating to the customer.

Once your vulnerable customers have been identified, the real question is how should they be handled. Next, we discuss eight tips for handling vulnerable customers at your company.

How to Handle Vulnerable Customers

1. Remove the Customer from Mainstream Sales or Marketing

Recognizing when a customer is vulnerable and may not benefit from aggressive sales or marketing tactics is important. Consider directing them to specialized support or customer care channels that can address their specific needs more effectively.

For example, if a customer mentions they are experiencing financial hardship and cannot afford additional services, redirect them to a specialized team trained in financial assistance programs rather than pushing them with upsell offers.

2. Create Fact Sheets to Educate Agents on Different Vulnerabilities

Develop resources and training materials that help call center agents understand various types of vulnerabilities, such as mental health issues, financial difficulties, or health concerns. This will enable them to provide more appropriate assistance.

For example, a fact sheet for call center agents to assist customers with hearing impairments might include guidance on asking about preferred communication methods, speaking clearly and at a moderate pace, using visual support like written instructions, being patient, confirming understanding, and avoiding background noise.

3. Find Out the Customer's Communication Preferences

Ask the customer how they prefer to communicate, whether it's via phone, email, chat, or other methods. Respecting their preferences can help them feel more comfortable and in control. For example, an agent could ask the customer, "Would you prefer to continue this conversation over the phone, or would you be more comfortable with an email response?"

4. Speak Clearly and Calmly

Use a clear and calm tone of voice when communicating with vulnerable customers. Avoid using jargon or technical language and be patient in explaining information. For example, if a customer becomes frustrated and begins talking faster and louder, make sure you remain calm and keep talking at a moderate pace in a low and relaxed tone.

5. Set Clear Expectations

Clearly outline the purpose and goals of the call from the beginning. Let the customer know what to expect regarding the conversation's duration and outcomes. For example, an agent could begin a call with, "Today, we will discuss the status of your recent order, and I'll help you track its delivery. Given the complexity of this call, it should take about 10-15 minutes. Do you have the time right now to properly address this?"

6. Check the Customer's Understanding After Each Key Point

Regularly confirm that the customer is following the conversation and comprehending the information. Encourage them to ask questions if anything is unclear. For example, ask questions such as, "Does that make sense so far?" and "Is there anything you'd like me to clarify?" after explaining something more complex.

If the customer is simply agreeing with what the agent is saying, for example by saying “mhmm” or “okay” when the agent checks their understanding, they may not actually be following. If the agent is unsure as to whether the customer truly understands, they can ask non-yes or no questions such as, “When did you originally expect your delivery to arrive?” This will give the agent more clues to indicate whether the customer is confused.

7. Summarise the Call at the End of the Interaction

Before ending the call, provide a concise summary of what was discussed and any action steps, if applicable. This helps ensure that the customer leaves with a clear understanding of the conversation.

For example, an agent could conclude an account issue resolution call with, "To recap, we've discussed the steps to resolve your account issue, and you should receive an email confirmation shortly." An agent could also ask the customer to summarize the call to check their understanding by asking, “Do you understand what is needing to be done to resolve your inquiry?”

8. Avoid Putting the Customer on Hold or Through to Another Staff Member

Minimize transferring customers to other departments or putting them on hold, which can lead to frustration and anxiety. Make an effort to resolve their concerns or inquiries during the initial interaction. Instead of transferring a customer with a product inquiry to another department, stay with them and say, "I'll get you the information you need right now."

How to Train and Support Staff to Handle Vulnerable Customer Calls

In addition to the eight tips, providing your staff with adequate support will boost their confidence in managing difficult calls effortlessly. You can further consider:

- Appointing 'champions' within your team who possess expertise in this area and can guide their colleagues.

- Training your staff to recognize vulnerable customers, understand their challenges, and effectively assist them.

- Developing and disseminating written protocols and policies related to handling vulnerable customers.

- Implementing predictive routing to direct calls to customer service representatives experienced in handling such calls.